The Commodities Futures Trading Commission (CFTC) and the Financial Industry Regulatory Authority (FINRA) are jointly issuing this Investor Bulletin to make investors aware of frauds involving investments in physical precious metals, in particular those involving self-directed individual retirement accounts (SDIRAs).

Gold or silver IRA frauds frequently target older workers and retirees because they typically have more money saved in their qualified retirement accounts than younger people. Those in or near retirement also commonly seek safe places to keep their wealth, to ensure they’ll have money well into the future or possibly to pass on to heirs.

However, precious metals prices can fluctuate just like other investments, and frauds that oversell safety, overinflate the price of metals, and overcharge fees and commissions rob older adults of their retirement nest eggs at a point in life when they might be unable to return to work or otherwise support themselves. Over the past decade, the CFTC has charged numerous companies with selling overpriced precious metals to customers, for an alleged total of more than $500 million in fraudulent sales.

Before you consider rolling over your retirement plan to a gold or silver IRA, here are 10 questions you should ask:

1. Should I respond to a precious metals dealer who calls or emails me with an attractive offer?

No. Never respond to cold calls, unsolicited emails, junk mail, late-night commercials or infomercials, social media posts or pop-up dealers who sell at public events or might ask to come to your home. These are all common tactics scammers use.

2. How do I find a reputable dealer?

Start in your local community with well-established dealers. Retail metal dealers are not regulated at the federal level. Consult local consumer organizations as well as your state’s attorney general or securities regulator to see if the dealer has a history of complaints. If you choose to shop online, verify the dealer’s physical address and how long it has been operating, and search online for the names of owners or salespeople for prior complaints or criminal allegations.

3. Is the precious metals salesperson a registered commodity trading advisor or investment professional?

In most cases, the precious metals salesperson trying to convince you to rollover your retirement savings has no professional experience and isn’t qualified to give trading, investment or tax advice. Most often they’re boiler-room telemarketers trained, rehearsed and incentivized to separate customers from their money. These operators might first call to size up your willingness to buy. They might offer a free gift or limited-time offer. Then, they might hand you off to their “lead trader” or a special expert to work with you one-on-one. If someone tries to persuade you to buy, suggests what to buy, how much or when, that’s advice, and they might be required to register with the CFTC, SEC, FINRA or your state regulator. Ask them directly if they’re registered, then verify it and take a look at their disciplinary histories, too. If they’re registered, this information is available from their regulators.

4. What’s a gold IRA?

Dealers use the “gold IRA” label for SDIRAs when they want older workers or retirees to use their retirement savings to buy gold or silver bullion. Money can be rolled over from a 401(k) or other retirement account to an SDIRA without penalty; however, once that cash is in the SDIRA, you’re on your own (that’s the self-directed part of SDIRAs). You no longer have fiduciaries or advisors there to help you guard against bad investments. Read this advisory from the SEC, FINRA, and the North American Securities Administrators Association (NASAA) to learn more about SDIRAs.

If you’re in or approaching retirement and looking to preserve wealth, it might not make sense for you to roll over an existing retirement account and pay high fees, commissions and administrative costs to purchase large amounts of bullion. In some cases, gold or silver IRA fraud victims had one-third to one-half of their savings drained by fraudsters’ markups, fees and commissions.

IRS rules for rollovers and self-directed IRAs are complex, and mistakes can be costly or result in losing the account’s tax-deferred status. If you’re considering big changes to your tax-advantaged retirement plan, consider consulting a tax professional or financial advisor to avoid owing additional taxes or penalties. More information about retirement plan tax rules is available from the IRS.

5. What’s the spot price?

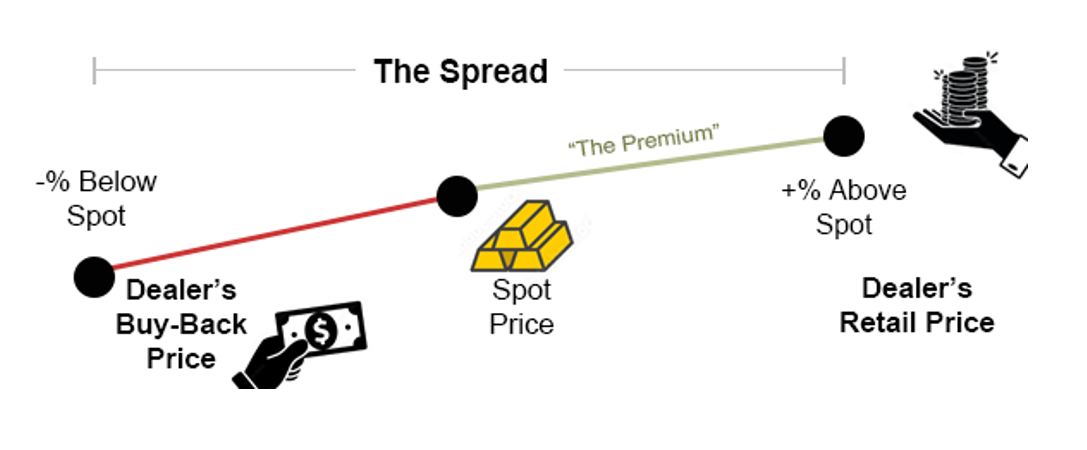

This is the cash price for immediate delivery of physical metal and should be easy to get from financial news or quote providers. The spot price is quoted in dollars per troy ounce. When comparing prices for specific coins or ingots, be sure you’re comparing the actual weight and price. If the current spot price is $2,000, for example, a half-ounce coin would be worth $1,000, plus the dealer’s markup or “premium.”

6. What’s the spread?

A dealer will always sell metal above the spot price and buy it back below the spot price. The difference between the dealer’s buy and sell price is known as the dealer’s spread. Each dealer sets its own spread, so it pays to shop around. Some fraudulent dealers have charged spreads of more than 300 percent while others dealers may charge less than 20 percent.

The greater the spread and other transaction or ongoing costs, the more the spot price would have to rise for you to make a profit. If the spread is too high, as in most frauds, it’s impossible for buyers to ever profit. In one case, a customer rolled over a $300,000 IRA, and the dealer allegedly took $150,000 in fees and commissions.

7. What fees and commissions will I be charged?

Ask for all fees, costs, commissions and agreed retail price in writing before signing a sales agreement or turning over any money. Also take the following steps:

- Multiply the weight of the metals you’re considering to the current spot price, and compare this figure with the retail price you’re being charged.

- Ask how much you would receive if you had to sell back the metal tomorrow. What’s the dealer’s buy-back price?

- Ask the telemarketer, “lead trader” or others you talk to how they’re paid. Are their commissions and fees included in the spread?

- Ask how the company earns its profit, especially if it appears to be giving away precious metal or offering other big freebies.

If fees aren’t available in writing before your purchase, that’s a red flag.

8. What other costs should I consider?

Other potential costs are storage, insurance, administrative fees, and possibly additional taxes and penalties if you take money from a qualified retirement account. Some fraudulent dealers have charged storage and insurance fees for metal that never existed. Metals in an SDIRA must be held by the IRA trustee or custodian. The custodian will provide account holders with an IRA statement that shows the “melt” value of the metals—the total bullion weight times the metal’s spot price. Review the SDIRA account statement carefully to ensure you received all the bullion you paid for and that you didn’t pay an overinflated price. IRA custodians also charge for their services, and SDIRA fees are typically higher than directed-IRA fees.

9. What’s the difference between bullion, numismatic or semi-numismatic?

Bullion coins or ingots share a common investment-grade purity and weight. “Numismatic” means the coins are rare or collectible. “Semi-numismatic” is a made-up industry term that really has no special meaning. These coins are sold as collectible but typically aren’t rare and carry no additional value. If anything, they’re likely less liquid—harder to sell—than bullion. Fraudsters might claim they’re selling numismatic or semi-numismatic coins “that will be worth more to collectors” to justify their overinflated spreads. Only certain bullion can be kept in an IRA. If someone tries to charge you more for collectible or “semi-numismatic” coins, it’s likely a scam. See other lies some gold IRA dealers commonly tell.

10. Are there other ways to own precious metals?

There are financial products such as commodity exchange-traded products (ETPs) or pools that offer exposure to metals prices. While these products come with their own fees and costs, you might be able to add them to your existing IRA, and they’re fully regulated. Be sure the ETP investment professional or commodity pool advisor is registered before investing. Review signs of possible commodity pool fraud.

If You Suspect Fraud

If you suspect you’ve been impacted by fraud or have knowledge of a fraudulent dealer, submit a whistleblower tip or fraud complaint at CFTC.gov/complaint. You can also report possible securities fraud to FINRA using its File a Tip form, or to your local state or provincial regulator. Seniors who have questions or concerns about their investment accounts can also call the FINRA Securities Helpline for Seniors at 844-57-HELPS (844-574-3577).

Learn more tips on investing wisely and avoiding fraud at cftc.gov and finra.org.

We’ve provided this Investor Bulletin for information purposes as a service to the public. It’s neither a legal interpretation nor a statement of CFTC or FINRA policy.